Download our e-book of Introduction To Python

Related Blog

Matplotlib - Subplot2grid() FunctionDiscuss Microsoft Cognitive ToolkitMatplotlib - Working with ImagesMatplotlib - PyLab moduleMatplotlib - Working With TextMatplotlib - Setting Ticks and Tick LabelsCNTK - Creating First Neural NetworkMatplotlib - MultiplotsMatplotlib - Quiver PlotPython - Chunks and Chinks View More

Top Discussion

How can I write Python code to change a date string from "mm/dd/yy hh: mm" format to "YYYY-MM-DD HH: mm" format? Which sorting technique is used by sort() and sorted() functions of python? How to use Enum in python? Can you please help me with this error? I was just selecting some random columns from the diabetes dataset of sklearn. Decision tree is a classification algo...How can it be applied to load diabetes dataset which has DV continuous Objects in Python are mutable or immutable? How can unclassified data in a dataset be effectively managed when utilizing a decision tree-based classification model in Python? How to leave/exit/deactivate a Python virtualenvironment Join Discussion

Top Courses

Webinars

AI in the Banking Industry

Josh B

3 years ago

Table of Contents

- Introduction

- Introduction to Natural Language Processing

- Human-Computer Interactions

- Understanding, Processing, and Generating Language

- Natural Language Processing is also used for Artificial Intelligence

- How Banks Use Natural Language Processing?

1. Intelligent Document Search

2. Investment Analysis

3. Real-Time Event and Risk Detection

4. Customer Service & Insights

5. Check balances and transfer money

6. Help customers manage recurring or late payments

7. Key Takeaways for Banking Executives

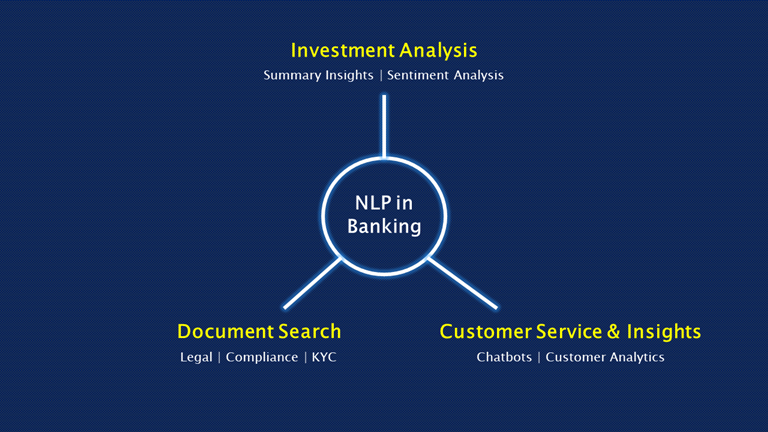

Introduction

Artificial Intelligence which is also called natural language processing

(NLP) and is being used by the branch to automate document processing,

analysis, and customer service activities. Three applications include:

- Intelligent document search -Finding relevant information from the large number of scanned documents.

- Investment analysis - routine analysis of earnings reports and news so that analysts can focus on alpha generation.

- Customer service & insights - Using chatbox to solve queries of customers faster.

There are lot of examples of how banks are using AI to increase their efficiency but let us first understand what natural language of processing is

capable of.

Introduction to Natural Language Processing

Natural Language Processing (NLP) is a branch of Artificial

Intelligence enables computers to understand human language and respond in

kind. This involves training computers to process speech and text and interpret the meaning of words, sentences, and paragraphs in context.

Human-Computer Interactions

We input speech or text (e.g. typing into a chatbot interface or

talking to a smart speaker) then the computer converts the text/speech into a format it can understand (e.g. speech to text and words are converted to vectors). This helps

computers cluster and classify different words.

Using its own data sets the computer figures out meaning and

context. The computer determines an appropriate response and converts

it to speech or text that we understand, and responds to us.

Every day we interact with apps that use natural language

processing in Google Translate, we input text and speech that Google translates

for us.

Gmail Smart Compose: Gmail completes the rest of the sentence you are about to type This feature uses the email subject and

previous emails to suggest relevant text.

Grammarly: Grammarly which checks the sentence structure and grammatical errors in your article, it is proved to be better than Microsoft World word heck

Smart speakers: No, your conversation with Alexa

isn’t magic (sorry).

Understanding, Processing, and Generating Language

Natural language processing is actually includes two related methods:

- Natural Language Understanding

- Natural Language Generation.

1. Natural language understanding (NLU) figures out the

meaning of the provided text and speech. it is similar to reading or listening. the process involves taking unstructured text and speech input from humans and converting

it to structured formats that computers understand. When you ask Alexa for a

weather report, for example, it uses natural language understanding to figure

out what you’re saying.

2. Natural language generation (NLG) refers to

computer-generated text and speech. NLG turns structured data into text and

speech that humans understand. Continuing our previous example, Alexa uses

natural language generation when it responds ‘It is sunny today. Would you like

to place an order for sunglasses?’

Natural Language Processing is also used for Artificial Intelligence

Natural language processing is often used with other AI

methods such as neural networks, deep learning, and optical character

recognition. Word2vec and Bag of Words are two popular natural language models

Without getting technical, neural networks are a subset of

machine learning. They can process text, classify words, cluster similar words,

and associate words and phrases with meanings when used for natural language

processing. Deep learning methods (i.e. neural networks with many layers) such

as Recurrent Neural Networks are also used.

Optical character recognition (OCR) enables computers to

recognize text in scanned documents. OCR can be used with natural language

processing to analyze scanned documents or handwritten text.

Various natural language techniques are used to determine

grammar rules and word meanings. Syntax analysis involves determining grammar

rules for words and clusters them according to similarity. The semantic analysis

involves deriving meaning and is used to generate human language. Semantic

analysis is challenging because human language rules are complex. Words and

phrases take on different meanings in different contexts. Colloquialisms,

idioms, and sarcasm further complicate matters.

Bag of Words and related algorithms are popular natural

language techniques that classify phrases and document by category or type. Bag

of Words simply counts how often each word appears in a document (a tally). The

algorithm then compares documents and determine the topic of each document.

This can be used to train neural networks. Gmail’s Smart Compose (mentioned

earlier) uses Bag of Words and Recurrent Neural Network models according to

Google. Search engines also use these techniques.

Word2vec is another popular natural language model. It is a

two-layer neural network that classifies text to determine to mean. It converts

words to mathematical ‘vectors’ that computers can understand. Vector

conversion is required because neural networks work better with numerical

inputs.

Vectors representing similar words are grouped together —

similar words are mathematically detected. Properly deployed, Word2vec can

infer word meanings with high accuracy based on past appearances. This is

useful for document search, sentiment analysis, and even recommendations of

which words should come next to complete a sentence.

How Banks Use Natural Language Processing?

Banks can apply natural language processing to large volumes

of text and speech data to extract information, gain insights, and streamline

manual tasks. While time and cost savings are obvious benefits, the ability to

identify key information (the proverbial needle in the haystack) can be a

competitive difference-maker.

Here are three areas where banks are applying natural

language processing.

1. Intelligent Document Search

JP Morgan Chase’s COIN (Contract Intelligence) software uses

natural language processing to help the bank’s legal team search and review

large volumes of legal documents.

COIN can reportedly save the bank’s legal team 360,000

hours, or 15,000 days, of document search tasks per year. It can extract key

data and clauses to help loan officers review commercial loan agreements, for

example.

COIN is apparently trained to recognize key information

(attributes) within documents that the bank’s legal team flags as important.

This enables the software to extract key information from documents that are

structured differently. The bank claims it extracted 150 relevant attributes

from 12,000 commercial credit agreements in seconds.

The software’s workings are not public since is used

internally. We can speculate that it could be powered by natural language

processing (to search within documents), optical character recognition (to

recognize characters in scanned documents), and machine learning (to classify

& cluster data within documents and to improve search algorithms over

time).

These methods can be applied to other banking activities. It

can help banks extract types of customer data that they don’t have time to

track. This data could help predict customer needs and identify cross-selling

opportunities. It can also speed up Know Your Customer (KYC) processes that

require document analysis, thereby making customer onboarding easier.

2. Investment Analysis

Securities research desks at banks are using natural

language processing to find valuable insights within mountains of company

reports and conference calls.

Banks previously hired armies of analysts to comb through

earnings reports and other filings and enter pertinent data into databases and

valuation models.

Now, banks are using natural language processing tools that

‘read’ hundreds of documents at a time and summarize key information for human

analysts. Speech analysis tools can ‘listen’ to analyst conference calls to

determine the tone and sentiment behind what company management is saying,

which can provide insight for equity analysis. These tools are huge time

savers and allow analysts to focus on alpha generation.

Banks also use natural language processing for sentiment

analysis. These tools analyze large volumes of news and social media posts to

extract key insights, determine how a company is perceived, or track market

reaction to significant events. These timely insights can inform analyst recommendations.

Banks either use tools developed internally or by vendors.

One vendor, Dataminr, claims to analyze social media and financial news to

identify relevant information including unexpected news, emerging trends, or

risks.

3. Real-Time Event and Risk Detection

Dataminr's clients are the first to know about critical

events and breaking information, enabling them to act faster…

www.dataminr.com

On the sell side, natural language generation tools

automatically generate reports based on earnings reports and news.

4. Customer Service & Insights

Major banks are introducing some level of customer service

automation through chatbots. In early 2019, Bank of America launched Erica, a

mobile virtual assistant, which soon amassed over one million users through the

BofA mobile app.

Erica accepts voice and text commands and combines

predictive analytics with natural language processing to help customers:

5. Check balances and transfer money

Searching for past transactions and account info on demand. Track spending habits (probably using predictive analytics,

which is a value-add that encourages more chatbot usage)

6. Help customers manage recurring or late payments

Chatbots let customers access account information and

perform basic transactions on their phones instead of using internet banking or

visiting their local branch. Executing transactions through a clean chatbot

interface may also take less time.

A bigger win for banks will be using natural language

processing for customer insights. Using methods related to intelligent document

search and sentiment analysis described above, banks can better understand and

predict customer needs and pain points. Sentiment analysis tools can monitor

social media to see what people are saying about the bank. Document search

tools can analyze feedback forms and customer information to respond to issues,

offer tailored products, and increase customer retention.

7. Key Takeaways for Banking Executives

Banking leaders realize that natural language processing can

automate routine document analysis, research, and customer service.

Cost savings are just the tip of the iceberg. By analyzing

text and speech data more quickly and extracting more actionable insights on

customers and the market, banks can serve customers better and make better

investments. The potential for greater market share and income is the real

difference makers.

While we have not covered all possible use cases, banks can

apply natural language techniques to any function that processes large volumes

of text or speech data. There are numerous applications in compliance, risk

management, or order execution, for example.

Key considerations include whether to build AI and natural

language processing tools in-house or to license software from an AI vendor. Building

in-house requires data scientists, developers, and an organizational AI

strategy. While this takes time, internally developed solutions might meet the

bank’s needs better than a vendor product. In addition, data quality and

availability across departments also have to be addressed.

Given the broad range of banking activities that natural

language processing can be applied to, banks that apply these solutions across

departments are likely to see far greater returns on investment.

Liked what you read? Then don’t break the spree. Visit our insideAIML blog page to read more awesome articles.

Or if you are into videos, then we have an amazing Youtube channel as well. Visit our InsideAIML Youtube Page to learn all about Artificial Intelligence, Deep Learning, Data Science and Machine Learning.

Keep Learning. Keep Growing.